The world of cryptocurrency has come a long way since its early days. What once seemed like a niche investment is now an essential part of many portfolios, with millions of people actively trading, investing, and using digital assets. As we move into 2025, the landscape of crypto is evolving rapidly, bringing new opportunities, challenges, and regulations. Whether you’re an experienced crypto trader or someone just starting to explore this digital frontier, understanding the key trends and developments in the crypto space is more important than ever. Here’s what you need to know about crypto in 2025.

1. The Rise of Central Bank Digital Currencies (CBDCs)

Key Trends for 2025:

- National digital currencies becoming mainstream

- Improved integration with traditional financial systems

- Enhanced security and privacy features

Why CBDCs are Shaping the Future of Crypto:

By 2025, Central Bank Digital Currencies (CBDCs) have moved from being a concept to a reality. Governments around the world are now launching their own digital currencies, and these are expected to become a key part of the global financial system. Unlike decentralized cryptocurrencies like Bitcoin and Ethereum, CBDCs are issued and controlled by central banks, making them more stable and less volatile.

“The emergence of CBDCs will bridge the gap between traditional finance and decentralized crypto markets, offering both stability and the benefits of digital currency,” explains a financial strategist.

CBDCs are designed to make digital payments more efficient, secure, and accessible. With faster transaction speeds and lower fees, these currencies are becoming increasingly attractive for both consumers and businesses. They are also expected to enhance financial inclusion, providing easy access to banking for those who are underbanked or unbanked.

Furthermore, governments are integrating these digital currencies with traditional financial systems, making it easier for users to switch between CBDCs and other digital assets. With better security features and privacy options, CBDCs are becoming a trusted and reliable way to transact digitally.

Pro Tip: Keep an eye on your country’s central bank plans for CBDCs. As adoption grows, these currencies may become a key part of your financial strategy, especially for cross-border payments or day-to-day transactions.

2. Decentralized Finance (DeFi) Takes Over

Key Trends for 2025:

- Greater adoption of DeFi protocols

- Lower fees and faster transactions

- Interoperability between different blockchain networks

Why DeFi is Changing the Game:

Decentralized Finance (DeFi) has exploded in popularity over the past few years, and by 2025, it’s become a mainstream alternative to traditional banking. DeFi allows people to borrow, lend, trade, and earn interest on digital assets—all without relying on banks or intermediaries. This decentralized model gives users more control over their finances while lowering fees and increasing transaction speeds.

“DeFi is revolutionizing the financial industry by democratizing access to financial services, eliminating the middleman, and offering new opportunities for passive income,” says a blockchain expert.

DeFi platforms are becoming more user-friendly, making it easier for people to access a wide range of financial products. From yield farming to liquidity pools, users can earn passive income by simply holding their assets on these platforms. Plus, many DeFi projects are focused on improving security and scalability, making it a safer and more efficient alternative to traditional finance.

In 2025, DeFi will become even more interconnected. Interoperability between different blockchain networks will allow users to seamlessly move assets across platforms, increasing the overall liquidity in the DeFi ecosystem.

Pro Tip: Consider exploring DeFi protocols for earning passive income. Just remember to do your research, as some projects can be high-risk.

3. NFTs: Beyond Art and Collectibles

Key Trends for 2025:

- NFTs as a tool for ownership and identity verification

- Integration with the gaming and entertainment industries

- Increased use in the real estate market

Why NFTs are More Than Just Digital Art:

Non-Fungible Tokens (NFTs) have already made a huge splash in the digital art world, but by 2025, they’re becoming much more versatile and integrated into everyday life. NFTs are unique digital assets that represent ownership of a particular item or piece of content, whether it’s art, music, video, or even physical assets.

“NFTs are evolving from being just collectibles to becoming a tool for ownership, verification, and even creating new economic models,” says a tech entrepreneur.

In 2025, NFTs are being used in a variety of new ways. For example, they’re being integrated into gaming, allowing players to own in-game assets that can be bought, sold, and traded across different platforms. The entertainment industry is also exploring the use of NFTs for ticketing, giving fans a secure and verifiable way to purchase and prove ownership of concert tickets or special event passes.

The real estate market is also beginning to adopt NFTs. Some platforms are now selling fractionalized ownership of properties through NFTs, making it easier for people to invest in real estate without needing to buy an entire property.

Pro Tip: Keep an eye on the evolving uses of NFTs, especially if you’re in the gaming, entertainment, or real estate industries. As their use cases expand, NFTs may become an essential part of digital asset management.

4. Crypto Regulation Gets Real

Key Trends for 2025:

- Clearer regulatory frameworks in major markets

- Increased transparency for crypto exchanges

- Regulatory compliance for decentralized projects

Why Regulation is Crucial for Crypto’s Future:

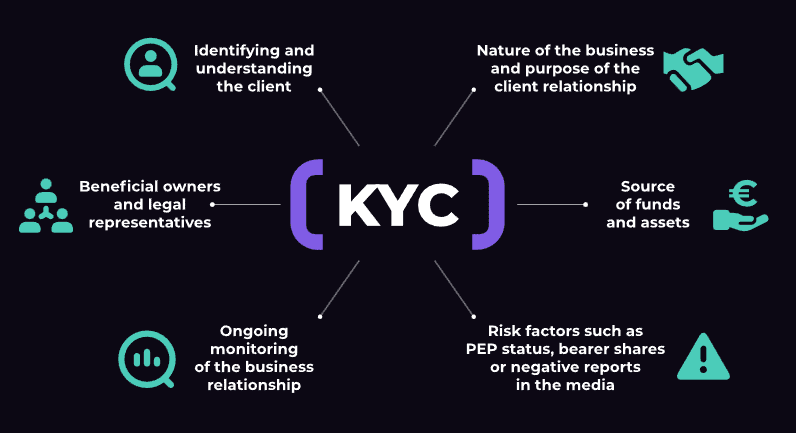

As the crypto space matures, governments around the world are beginning to implement clearer regulations to protect investors and prevent illicit activities. By 2025, we’ll see much more robust regulatory frameworks for cryptocurrencies, including rules on taxation, anti-money laundering (AML), and know-your-customer (KYC) requirements.

“Regulation will bring much-needed clarity and legitimacy to the crypto space, allowing for wider institutional adoption and reducing risks for investors,” says a compliance expert.

While some crypto enthusiasts have resisted regulation in the past, many now see it as a necessary step toward greater legitimacy and mass adoption. With clearer regulations, crypto exchanges and DeFi projects will need to comply with new rules, ensuring that they operate transparently and with the same standards as traditional financial institutions.

This increased regulatory oversight will also help reduce the risk of scams and fraudulent activities, making it safer for both new and seasoned investors to participate in the crypto market.

Pro Tip: Stay informed about regulatory changes in your region. Understanding the legal landscape will help you navigate the crypto space more safely and avoid any unexpected surprises.

5. The Future of Crypto Security

Key Trends for 2025:

- Enhanced encryption and security protocols

- Multi-layered authentication systems

- Increased focus on decentralized identity (DID) solutions

Why Crypto Security is a Top Priority:

With the rise of cryptocurrency comes an increased risk of cyberattacks, fraud, and theft. In 2025, crypto security is more important than ever. As the value of digital assets continues to grow, so does the incentive for hackers and bad actors. However, the crypto industry is rising to meet these challenges by developing stronger security measures.

“Crypto security isn’t just about protecting assets—it’s about safeguarding trust in the ecosystem,” says a cybersecurity analyst.

In 2025, we’ll see advanced encryption technologies and multi-layered authentication systems becoming standard for crypto exchanges, wallets, and DeFi platforms. This will help ensure that your funds remain secure and that you can access your assets with confidence.

Decentralized Identity (DID) solutions are also gaining traction. These systems allow users to maintain control over their personal data, reducing the need to trust centralized platforms with sensitive information. By using blockchain to store identity credentials, DIDs provide a secure and private way to verify identity while interacting with the crypto space.

Pro Tip: Prioritize security when using crypto platforms. Use hardware wallets for long-term storage, enable multi-factor authentication, and keep your private keys safe.

Writer’s Thoughts

As we look ahead in 2025, it’s clear that crypto is no longer just a passing trend—it’s a fundamental part of the global financial landscape. With innovations like CBDCs, DeFi, NFTs, and new regulations on the horizon, the crypto space is poised to offer more opportunities than ever before. While the industry still faces challenges, including security concerns and regulatory hurdles, the future of crypto looks brighter than ever.

“Crypto is transforming the way we think about money and value. The next few years will be pivotal in shaping how it’s integrated into our daily lives,” says a blockchain expert.