In today’s fast-paced world, managing personal finances can feel overwhelming. But thanks to technology, there are now smarter, easier, and more efficient ways to stay on top of your money. By 2025, finance apps have evolved beyond just tracking your spending; they now help you optimize every aspect of your financial life. Whether you’re looking to budget better, invest more effectively, or plan for retirement, these 5 game-changing apps are revolutionizing the way we manage our finances. Here’s a look at the top tools that will help you take control of your financial future in 2025.

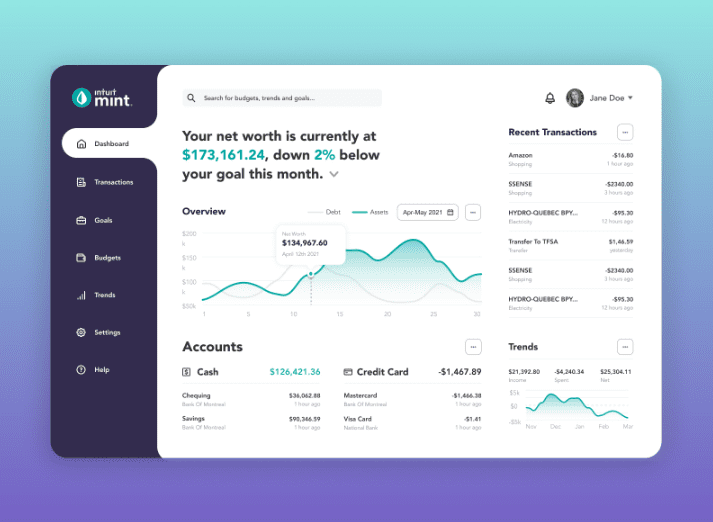

1. AI-Powered Budgeting: Mint 2.0

Key Features for 2025:

- Real-time spending analysis

- Personalized savings recommendations

- Predictive budgeting powered by AI

Why Mint 2.0 is a 2025 Game-Changer:

Mint has always been a go-to for budgeting, but its 2025 version is a whole new level of smart. Thanks to AI, Mint 2.0 now analyzes your spending habits in real-time and offers personalized advice to help you keep your budget on track.

“Budgeting is the foundation of financial success, and AI is making it easier than ever,” says a financial planner. The app automatically suggests ways to cut back on spending and find more affordable alternatives. For example, if you’re spending too much on dining out, Mint will recommend budget-friendly restaurants or suggest meal-prepping ideas to help you save money.

Another standout feature is predictive budgeting. Mint’s AI predicts your future expenses based on historical trends and adjusts your budget accordingly. This means if you usually spend more on gifts around the holidays or on travel in the summer, Mint will automatically factor that into your budget ahead of time.

Mint 2.0 now offers a comprehensive view of your entire financial life, integrating with your investment accounts, crypto wallets, and loan systems. This makes it easy to track your net worth and see how every decision impacts your financial goals.

Pro Tip: Use Mint’s goal-setting feature to save for big-ticket items, whether it’s a home, a dream vacation, or even an emergency fund. Setting and tracking goals has never been easier.

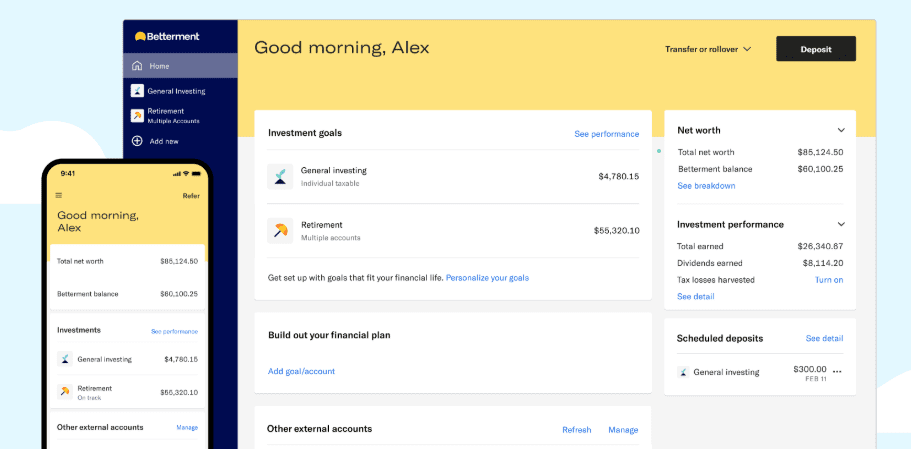

2. Automated Investing: Betterment 2025

Key Features for 2025:

- AI-driven portfolio management

- Tax-loss harvesting for optimized returns

- Sustainable investing options (ESG-focused)

Why Betterment is a 2025 Must-Have:

Betterment has been a leader in robo-advisory services for years, and its 2025 version makes it even more powerful and personalized. The app now uses AI to create highly tailored investment portfolios that adjust based on your unique financial situation, risk tolerance, and goals.

“The future of investing isn’t just about returns—it’s about customization,” explains a fintech expert. Betterment 2025 will optimize your portfolio not just for returns but also for taxes, incorporating tax-loss harvesting to reduce your taxable income and maximize returns over the long term.

In addition, Betterment’s sustainable investing options have expanded. With more people concerned about environmental and social impacts, Betterment now allows you to build a portfolio that aligns with your values, focusing on environmental, social, and governance (ESG) factors.

Betterment’s low fees and AI-driven rebalancing features make it perfect for hands-off investors. Whether you’re saving for retirement or just looking to grow your wealth, Betterment does the heavy lifting for you.

Pro Tip: Start small with Betterment’s automated investing. With automatic rebalancing and low fees, it’s perfect for those who want to grow their investments without constant management.

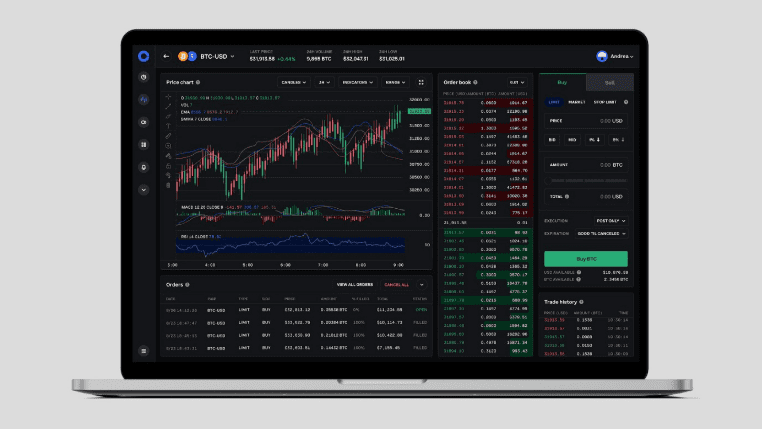

3. Crypto Management: Coinbase Pro 2025

Key Features for 2025:

- Advanced trading tools for beginners and experts

- Staking rewards for passive income

- Enhanced security with biometric authentication

Why Coinbase Pro 2025 is a Game-Changer:

Cryptocurrency isn’t just a niche investment anymore—it’s a mainstream part of many people’s portfolios. Coinbase Pro 2025 is the ultimate platform for managing your crypto assets, whether you’re a beginner or a seasoned pro. The app combines powerful features with ease of use, making crypto trading and investing more accessible than ever.

“Cryptocurrency is transforming the global financial landscape, and apps like Coinbase Pro are crucial for those looking to diversify their portfolios,” says a crypto strategist. Coinbase Pro’s advanced trading tools now include detailed charting, margin trading, and enhanced order types, allowing you to execute complex strategies with ease. For beginners, the platform offers an intuitive interface to get started with simple buys and sells.

A standout feature of Coinbase Pro is its staking capabilities. By holding certain cryptocurrencies like Ethereum, you can earn passive income through staking rewards. This allows you to generate returns on your assets while simply holding them in the app.

In terms of security, Coinbase Pro 2025 takes it up a notch with biometric authentication, ensuring your funds stay secure. The app also integrates seamlessly with decentralized finance (DeFi) platforms, allowing you to lend, borrow, and earn interest on your crypto assets.

Pro Tip: Diversify your crypto portfolio to minimize risk. With the volatility of the crypto market, spreading your investments across different assets can help you ride out fluctuations and maximize your returns over time.

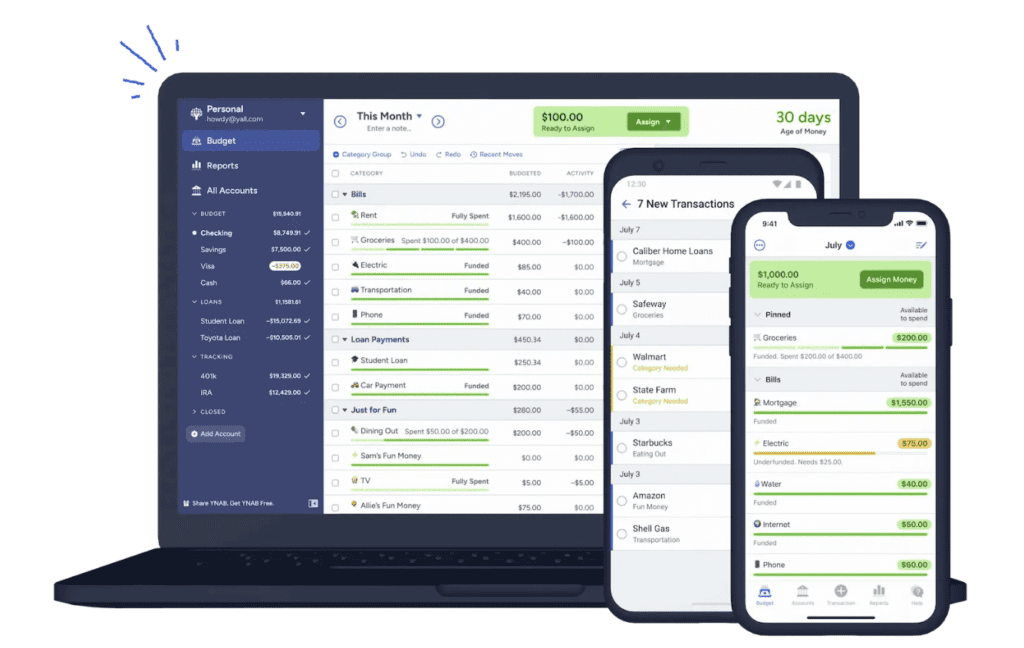

4. Expense Tracking: YNAB 2025 (You Need A Budget)

Key Features for 2025:

- Real-time expense tracking

- Goal-oriented budgeting

- Integration with voice assistants like Alexa and Google Assistant

Why YNAB is a 2025 Trend:

YNAB has long been known for helping people give every dollar a job, and its 2025 update makes it even more intuitive. YNAB 2025 is an even more powerful tool for budgeting and expense tracking, thanks to the integration of AI and real-time syncing with your bank accounts and credit cards.

“Expense tracking is about more than just balancing the books—it’s about understanding your spending habits and making smarter choices,” says a personal finance expert.

With YNAB’s new AI-powered features, the app can now analyze your spending patterns and suggest ways to adjust your budget for better results. For example, if you tend to overspend in certain categories, YNAB will offer personalized recommendations for cutting back.

Real-time expense tracking means that every transaction is automatically logged, giving you an up-to-the-minute view of your financial situation. You can see where your money is going and make changes on the fly.

And for added convenience, YNAB 2025 now integrates with voice assistants like Alexa and Google Assistant, so you can log expenses and check your budget using simple voice commands.

Pro Tip: Use YNAB’s debt payoff tools to tackle credit card balances or loans faster. With clear goals and a structured budget, you can eliminate debt and gain control over your financial future.

5. Personal Finance Hub: Empower 2025

Key Features for 2025:

- Net worth tracking

- Retirement planning tools

- Investment fee analyzer

Why Empower 2025 is the Ultimate Finance Hub:

Empower, formerly known as Personal Capital, has long been a powerful app for managing both your day-to-day spending and your investments. By 2025, it’s become the ultimate personal finance hub, offering an all-in-one platform that helps you manage your entire financial life—from budgeting and investing to retirement planning.

“Financial wellness is about more than just tracking expenses—it’s about taking control of your entire financial life,” says a financial planner.

Empower’s 2025 update includes a comprehensive net worth tracker, which pulls together your assets and liabilities in one place. This gives you a real-time view of your financial health and helps you set better goals. Whether you’re saving for retirement, a down payment on a home, or a family vacation, Empower gives you the tools to track your progress.

The app also offers detailed retirement planning tools, helping you simulate different scenarios to see if you’re on track for your future goals. If you’re behind, Empower will offer suggestions on how to catch up, such as increasing your retirement contributions or adjusting your investment strategy.

Empower’s investment fee analyzer is another standout feature. It helps you understand the true cost of your investments by breaking down the fees you’re paying and offering suggestions for ways to lower those costs over time.

Pro Tip: Use Empower’s retirement planner to simulate different saving scenarios and ensure you’re on track for a comfortable retirement. It’s never too early to start planning.

Writer’s Thoughts

As we move further into 2025, it’s clear that the way we manage our finances is changing. With the help of AI, automation, and seamless integrations, these 5 apps are making it easier than ever to manage everything from daily expenses to long-term investments. Whether you’re tracking spending, investing, or planning for retirement, these tools are here to help you take control of your financial future.

“Technology is transforming finance, putting the power of wealth-building in your hands,” says a fintech expert.